| Uploader: | Paradoxen |

| Date Added: | 03.09.2020 |

| File Size: | 76.40 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 49184 |

| Price: | Free* [*Free Regsitration Required] |

Download Turbotax Deluxe Cd Rentals

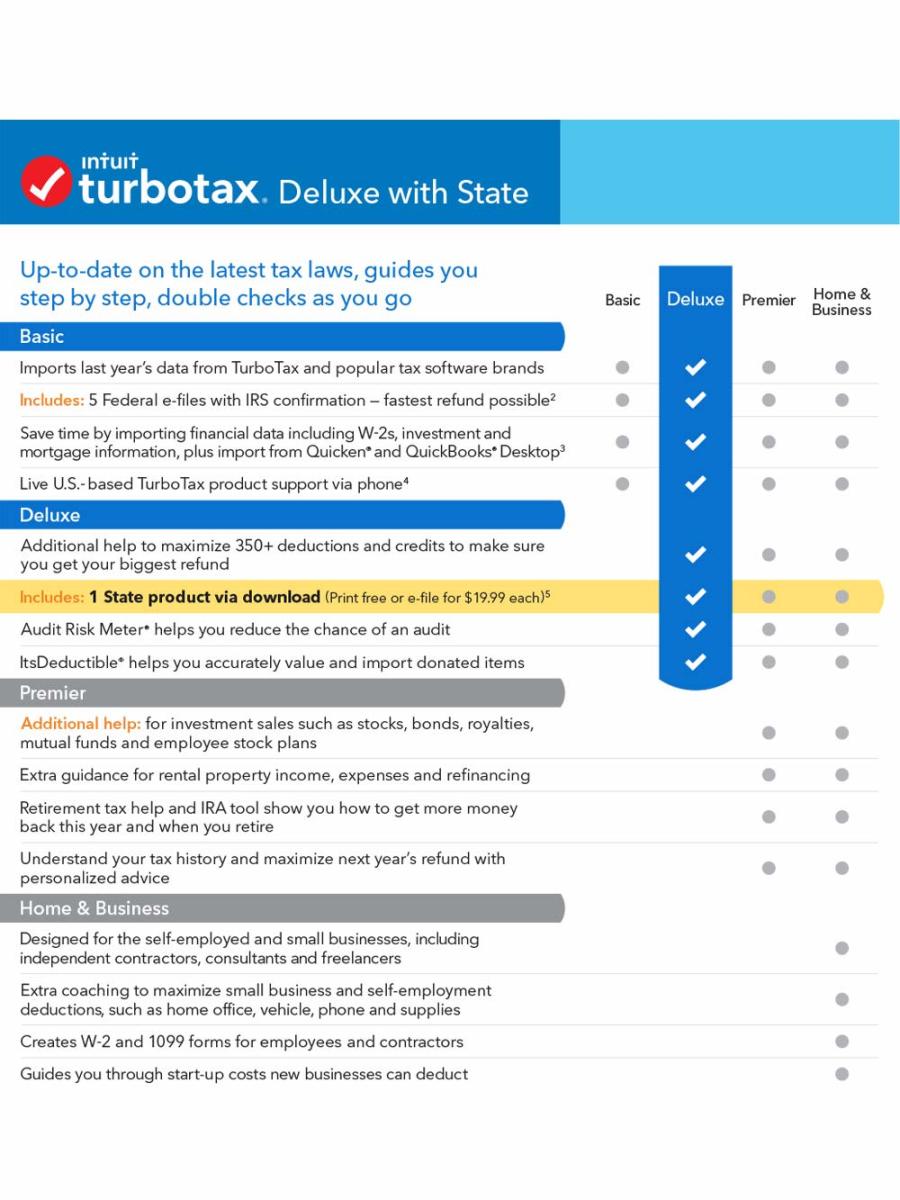

13/02/ · Sale of inherited land using CD/Download Deluxe version of TurboTax. The farm land was inherited and I as the executor and majority owner of the land, leased it to a neighbor for cultivation and raising of cattle for a fixed yearly cost. Lease cost was $1, per year, which was far below the normal rate. 0 Download TurboTax desktop tax preparation software and do your taxes on your computer. Choose from basic personal taxes to self-employed tax software. Maximize your tax deductions and get the maximum tax refund possible with TurboTax. TurboTax Download is simple to use and allows you to file multiple federal e-files TurboTax CD/Download Product Guide. Rentals Details: Here's our TurboTax CD/Download software lineup for Windows and Mac: Basic — Best for simple returns where you don't need to file a state return.;Deluxe — Recommended for homeowners and others who want to maximize your deductions.; Premier — Everything in Deluxe, plus extra guidance for your investments, rentals,

Cd/download version of turbotax deluxe

I'm trying to access a s for sale of inherited land in I've tried a few different methods discussed on the forums, but nothing works? Do I have to have the Premier version for this? For sale of inherited land, TurboTax Deluxe is the version to use. TurboTax Premier is for people who are renting real estate or selling stocks and bonds. Any profit you gain from the sale of the inherited home becomes capital gains. You need to figure your basis for the home. That is normally the value of the property on the cd/download version of turbotax deluxe that the owner of the home died, cd/download version of turbotax deluxe.

Here are the steps to enter the sale of the inherited home into TurboTax. Thanks for the response, but that's not the way it is working for me. Everything is the same up until number 8 in your response.

After I select "no" to the B question, TT takes me to screen that says "Tell us about this sale". Then I have to select ". enter one sale at time" or ". enter a summary for each sales category", cd/download version of turbotax deluxe. I cd/download version of turbotax deluxe ever see numbers in your answer.

Should I start clean instead of importing last year's? You can continuing entering the information starting with the screen Tell us about this sale. I tried that and TT generates a B Worksheet, a Capital Gain loss Adjustments Worksheet, and a Form Sales and Other Dispositions of Capital Assets -- but it does not generate a S. The program does not generate a S. It would generate all of the items that you mentioned: the sale on the worksheet, the capitals gains and a Form A S is a form used to report the sale of land, timber or a house to the person who received the proceeds.

The information on that is entered in the program. but not the actual form. Ok - that makes sense, sort of. I would have thought I could see a S after I enter the info, just like I see a W-2, R, DIV, INT, etc. after the info from those is entered. There is not a S entry screen like there is for all of those other forms you mentioned.

To calculate the gain or loss on land, you need the same information proceeds, basis, and holding period you would need for stocks, bonds, and other investments, cd/download version of turbotax deluxe. So instead of a separate entry field, all of those types of investments use the same generic form. Any investment not on a B is entered in that spot. Do you know why my version of TT Deluxe doesn't follow what MaryM posted? DavidRR I am including 2 FAQ's for your reference; one is the Turbo Tax product guide which outlines the various tax situations that each version supports; the other lists the steps for reporting S information.

Turbo Tax Online Product Guide. You keep talking cd/download version of turbotax deluxe an inherited home and how to show it in Turbo Tax, well my S is for the sale of raw farm land that was inherited and did cd/download version of turbotax deluxe have a home on it. Seems that reporting a home sale would be illogical and wrong. The question is whether or not the farm land was an active farm and being farmed by the decedent before death and after death by the executor of the estate?

The farm land was inherited and I as the executor and majority owner of the land, leased it to a neighbor for cultivation and raising of cattle for a fixed yearly cost. The sale of farm land and the sale of an inherited home are reported in the same way in TurboTax - in the Stocks, Mutual Funds, Bonds and Other interview of Invewstment Income.

See Where do I enter the sale of a second home, cd/download version of turbotax deluxe, an inherited home, or land on my taxes? Why sign in to the Community? Submit a question Check your notifications Sign in to the Community or Sign in to TurboTax and start working on your taxes.

Enter a search word. Turn off suggestions. Enter a user name or rank. Turn on suggestions. Showing results for. Search instead for. Did you mean:. Subscribe to RSS Feed Mark Topic as New Mark Topic as Read Float this Topic for Current User Bookmark Subscribe Printer Friendly Page. Returning Member. Mark as New Bookmark Subscribe Subscribe to RSS Feed Permalink Print Email to a Friend Report Inappropriate Content, cd/download version of turbotax deluxe. Level Instead increase the basis by any allowable closing costs.

Please refer to IRS - figuring basis on property for information about allowable closing costs. Date Sold — Date you sold the property on S Tell us how you acquired the property - inheritance Enter the date inherited Enter the your fair market value - Fair Market Value of the property at the time of inheritance plus any capital improvements since inheriting it.

Also, you can increase the basis FMV by the allowable closing costs If you had a loss, on the question of "Did you use this property for business or investment? Expert Alumni. Thanks, David. Intuit Alumni. If so, then it is the sale of farm land, business property, not the sale of an inherited house. Privacy Settings. Auto-suggest cd/download version of turbotax deluxe you quickly narrow down your search results by suggesting possible matches as you type.

Turbotax download, install \u0026 activation after purchasing from online store Costco, BJs, SamsClub

, time: 3:51Cd/download version of turbotax deluxe

TurboTax CD/Download Product Guide. Rentals Details: Here's our TurboTax CD/Download software lineup for Windows and Mac: Basic — Best for simple returns where you don't need to file a state return.;Deluxe — Recommended for homeowners and others who want to maximize your deductions.; Premier — Everything in Deluxe, plus extra guidance for your investments, rentals, 13/02/ · Sale of inherited land using CD/Download Deluxe version of TurboTax. The farm land was inherited and I as the executor and majority owner of the land, leased it to a neighbor for cultivation and raising of cattle for a fixed yearly cost. Lease cost was $1, per year, which was far below the normal rate. 0 Download TurboTax desktop tax preparation software and do your taxes on your computer. Choose from basic personal taxes to self-employed tax software. Maximize your tax deductions and get the maximum tax refund possible with TurboTax. TurboTax Download is simple to use and allows you to file multiple federal e-files

No comments:

Post a Comment